NEW YORK—May 11, 2022—CleanCapital announced today that it has closed on a credit facility of up to $200 million to support its pipeline of distributed solar and energy storage projects. Rabobank will act as mandated lead arranger, administrative agent, and collateral agent.

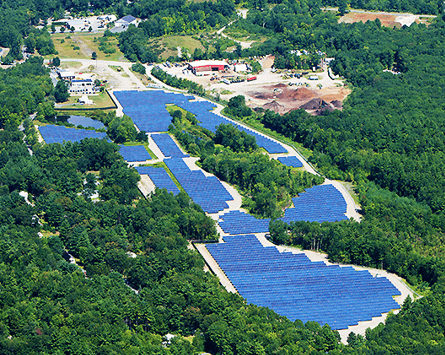

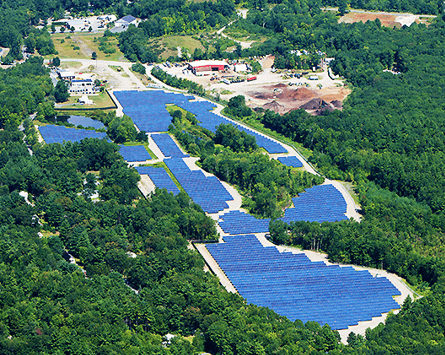

The facility is structured as an accordion and will grow over time to accommodate the company’s expanding portfolio of operating solar assets. The initial anchor portfolio comprises 35 solar assets across 11 states, with a total capacity of 29 megawatts. The facility can accommodate a wide range of offtake types, including utility offtake, C&I PPAs, net metering, and community solar.

“As CleanCapital continues to expand its portfolio, efficiency and speed on the financing side will be key to our success,” said Melinda Baglio, Chief Investment Officer and General Counsel at CleanCapital. “This facility will enable us to be even more responsive to market opportunities, further cementing our reputation as a leader in deploying capital into this segment.”

“CleanCapital is one of the leading distributed generation players in the U.S. and this facility provides the company with a flexible financing vehicle through which it can meet its portfolio growth targets,” said Claus Hertel, Managing Director, Project Finance. “Rabobank is pleased to have structured a financing to allow CleanCapital to build out its portfolio in the distributed sector, an increasingly important space to support decarbonization goals and an identified area of growth for Rabobank.”

Kirkland & Ellis acted as legal counsel to CleanCapital and Norton Rose Fulbright advised Rabobank. Investment Bank Javelin Capital acted as advisor to the clean energy investment platform on the transaction.

About CleanCapital

CleanCapital is an industry-leading clean energy investment platform. Since 2015, the company has worked to accelerate investment in distributed solar and storage assets to address the urgent threat of climate change. Its leading-edge technology platform facilitates the evaluation and acquisition of clean energy assets with speed and certainty. More information can be found at cleancapital.com.

About Rabobank

Rabobank Group is a global financial services leader providing wholesale and retail banking, leasing, and real estate services in more than 38 countries worldwide. Founded over a century ago, Rabobank today is one of the world’s largest banks with over $660 billion in assets.

In the Americas, Rabobank Wholesale Banking North America is a premier corporate and investment bank to the food, agribusiness, commodities and energy industries. Rabo AgriFinance, a subsidiary of Rabobank, is a leading financial services provider for farmers, ranchers and agribusinesses in the United States. Together, we provide sector expertise, strategic counsel and tailored financial solutions to clients across the entire value chain. Visit www.RabobankWholesaleBankingNA.com and www.RaboAg.com.