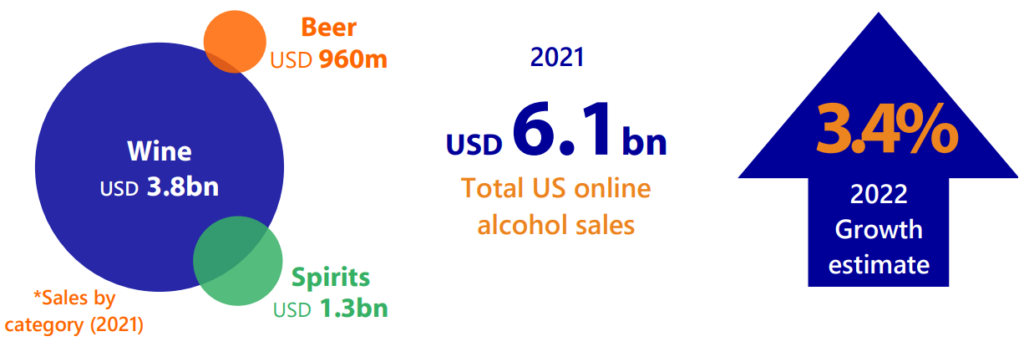

Alcohol e-commerce sales have been climbing rapidly for years, but the pandemic thrust that growth into hyperdrive. U.S. online alcohol sales grew by 131% from 2019 to 2021 with more growth expected in 2022, according to Rabobank’s newly released 2022 Alcohol E-commerce Playbook.

In this Q&A, report author Rabobank F&A Beverages Analyst Bourcard Nesin discusses what he discovered during his e-commerce research and what industry leaders can do to maximize their future success in the channel.

Q: The 2022 Alcohol E-Commerce Playbook was released in January. What separates this report and its findings from other reports on the industry?

A: What makes it different is that e-commerce is an incredibly fragmented channel. There are a lot of different operators, business models and regulations that can vary dramatically by state. If you want to get an accurate measure of the U.S. online alcohol market, you’ve got to get your hands dirty. We had to work one-on-one with a huge number of companies to produce this report. Of course, we spoke with all the e-commerce platforms and retailers, but to offer truly actionable insights, we had to work with the actual brands.

We kind of did a census, in this regard: we spoke with over 30 alcohol companies and their e-commerce leaders. If you add up all those companies’ combined sales, they more than 70% of U.S. alcohol business. Only Rabobank has that kind of access and close relationships with the most powerful companies in the industry, and that’s why no other report can capture the pulse of the industry better or more completely than this one.

Q: Taking a 30,000-foot view of the industry, what are the key insights that stakeholders need to know about the alcohol e-commerce sector’s pandemic-era growth and where it is heading in 2022 and beyond?

A: To state the obvious, growth in 2020 was bonkers. Online alcohol sales grew way faster than other food and beverage categories. Yes, consumer demand for online services rose during the pandemic, but that is not why alcohol sales growth outpaced other categories. I think the exceptional growth in the category is a function of companies all along the value chain (brands, distributors, and retailers) finally responding to consumer demand that was already there. Retailers and platforms like Drizly and Instacart were expanding their retail footprint and giving consumers the opportunity to buy alcohol for the first time. Meanwhile alcohol companies were putting more marketing dollars and attention into their e-commerce business, which helped drive awareness of these new online offerings and availability from retailers. That infrastructure is permanent. Thus in 2021, when things started returning to normal, despite rising vaccination rates, increased consumer mobility and on-premise sales recovering, online alcohol sales did not return to their pre-pandemic norm. That’s an incredible testament to the structural changes made over the past two years and the prospect for future growth in the channel.

Q: For industry CEOs reading this, what are the top takeaways or lessons they need to know as they develop their e-commerce strategy for the coming years?

A: I’ve asked dozens of e-commerce leaders the same question: “what is your CEO most likely to misunderstand about your work?” The responses were nearly unanimous: CEOs tend to dramatically undervalue something called “digitally-influenced sales.”

E-commerce is an amazing place to build awareness, drive sampling and tell your brand’s story. Virtually every single sale, online and in-store, is influenced by your brand’s digital presence. So, for example, if a consumer stumbles onto your brand’s product page on Total Wine & More or Walmart.com or Instacart and you fail to tell a compelling story (which you can do with great images of the brand, accurate product attributes, telling the story of the brand’s origin and production, as well as offering third-party reviews and recipes), that failure will follow you as the consumer shops online or in-store. Thus, CEOs should not base their e-commerce investment on top-line e-commerce sales but must include the incredibly large influence of digitally influenced sales.

Q: For businesses just now stepping into online sales, is there a secret sauce for success in e-commerce?

A: One thing I’ve learned in writing this report is that nobody really knows what they are doing, at least not yet. At this point, the difference between the companies succeeding in e-commerce and those that are still struggling to manage their business is simple: resource allocation.

Companies that invest in their e-commerce operation (i.e. they hire enough dedicated e-commerce FTEs to manage the business), and invested early and proactively in those e-commerce operations, have a dramatic advantage over their competition. The rapid rise of e-commerce sales require huge amounts of experimentation and education. Most e-commerce teams simply do not have enough resources to manage even the most fundamental aspects of their business. And as I just pointed out, failure in the e-commerce channel will impact your entire business, online and off.

Q: In your talks with industry leaders, are there specific things businesses get wrong about e-commerce? What are companies doing to limit their own success?

A: Most companies are not investing enough in their digital capabilities, but it’s not just the size of your investment but where those resources are going! There are some companies that would rather sink thousands or even millions of dollars into digital advertising when they would be much better served hiring a few extra people to their e-commerce team.

At this point, companies would be better served building a team that has the capacity and skill sets to optimize their digital media spend. For example, if you pay for a keyword (e.g. placement-in-search) on Drizly or Instacart, but your content is out-of-date or incorrect, the return on advertising spend will be close to zero. Or, if you run a shoppable Instagram ad, but the ad links to a retailer in which your brand is out-of-stock, not only will your return on advertising spend be zero, but you’ve also just created a frustrating experience that hurts your brand’s image with a highly motivated consumer.

Alcohol brands need to get the fundamentals right if they want a great return on their bottom-funnel marketing campaigns (i.e. marketing campaigns designed to end in a sale). Brands should focus on improving the quality of their content, the quality of their messaging and A-B testing whatever marketing dollars they do deploy… and that takes people!

Q: What impact do you hope this report has? How would you like industry leaders to respond to the information and advice you offered in the report?

A: I hope this report scares them a little bit. I hope industry leaders read this report and think “what have I been doing… why didn’t I act sooner?” I want them to wonder why they weren’t doing this years ago when I and others at Rabobank were imploring them to recognize e-commerce as a critical place to invest.

To be honest, industry leaders have constantly given lip service to e-commerce and talked about innovation, but at the same time, e-commerce teams are starved of resources. I think it really is time for leaders to put their money where their mouth is.

Q: As CEOs and industry leaders look at the 2022 Alcohol E-Commerce Playbook for insight, what else can they expect from you and Rabobank’s beverage analysts in 2022?

A: Publication-wise, I’m working on a projection for alcohol sales in the U.S. through 2025. I’ve interviewed leaders at 25 of the country’s top brands and we’ll be able to compare where the industry sees itself going and compare that with Rabobank’s own model. That should be available in Q1 2022.

Also, the top question I get from industry leaders is “what are my competitors doing?” So, through our podcast, Liquid Assets, I’ll be hosting conversations with e-commerce leaders throughout the year. It’s a chance for alcohol industry leaders to learn best practices and innovative growth strategies from their peers.

About Rabobank

Rabobank Group is a global financial services leader providing wholesale and retail banking, leasing, and real estate services in more than 38 countries worldwide. Founded over a century ago, Rabobank today is one of the world’s largest banks with over $660 billion in assets.

In the Americas, Rabobank Wholesale Banking North America is a premier corporate and investment bank to the food, agribusiness, commodities and energy industries. Rabo AgriFinance, a subsidiary of Rabobank, is a leading financial services provider for farmers, ranchers and agribusinesses in the United States. Together, we provide sector expertise, strategic counsel and tailored financial solutions to clients across the entire value chain. Visit www.RabobankWholesaleBankingNA.com and www.RaboAg.com.

About Rabobank

Rabobank Group is a global financial services leader providing wholesale and retail banking, leasing, and real estate services in more than 38 countries worldwide. Founded over a century ago, Rabobank today is one of the world’s largest banks with over $660 billion in assets.

In the Americas, Rabobank Wholesale Banking North America is a premier corporate and investment bank to the food, agribusiness, commodities and energy industries. Rabo AgriFinance, a subsidiary of Rabobank, is a leading financial services provider for farmers, ranchers and agribusinesses in the United States. Together, we provide sector expertise, strategic counsel and tailored financial solutions to clients across the entire value chain. Visit www.RabobankWholesaleBankingNA.com and www.RaboAg.com.